Top 5 Travel Credit Cards

We all know travel enriches our lives, and as the saying goes, “where you spend your money reveals what is important to you.” If you prioritize luxurious travel experiences, let’s ensure you’re rewarded for your investment.

As a luxury travel advisor, I see travel credit cards as powerful tools for discerning travelers, but understanding their nuances is crucial. Let’s explore the benefits and considerations of using credit cards to elevate your travel experiences.

Pros:

- Rewards & Points: Accumulate points or miles redeemable for flights, hotel stays, upgrades, and other travel experiences. These can offset travel costs and unlock exclusive benefits.

- Lounge Access: Some cards offer Priority Pass memberships or direct access to airport lounges, providing a more comfortable and productive pre-flight experience.

- Additional Perks: Some cards offer benefits like car rental insurance, global assistance services, and hotel status matches, enhancing your travel experience.

Cons:

- Annual Fees: Many premium travel cards have high annual fees. You just need to make sure the points/miles earned and perks justify the cost.

- Temptation to Overspend: Mindful spending is crucial to avoid debt and maximize reward potential.

- Credit Score Impact: Frequent applications can affect your credit score so choose your cards strategically.

- Reward Complexity: Different cards have varying rewards structures and redemption options.

My Recommendations:

- Consider your travel habits: Analyze your annual travel spend and frequency. This will help you choose a card aligned with your travel style.

- Evaluate your budget: Be realistic about how much you can comfortably afford to spend annually on fees.

- Understand redemption potential: Research how and where you can redeem your points or miles to ensure they align with your travel goals.

- Prioritize bonus categories: Look for cards that offer bonus points or miles on purchases you already make, like hotels, airlines, or dining.

- Compare fees and benefits: Don’t just focus on sign-up bonuses. Scrutinize annual fees, lounge access, and other perks to find the best value.

Credit Cards Based on Your Travel Style

If you’re a frequent traveler, cards with high rewards on travel purchases are best. Look for bonus points or miles on flights, hotels, and other travel expenses. Many premium travel cards offer access to airport lounges, providing a more comfortable and relaxing pre-flight experience.

If you don’t travel frequently, a high annual fee may not be worth it. Look for cards with flexible rewards that can be redeemed for travel, cash back, and other options.

If you’ve chosen Melted & Moved for travel planning, you don’t need to worry about cards with hotel status, meet-and-greet services, or concierge services. We have destination partners with local knowledge who will help you coordinate the details of your trip. In addition, we’ve worked hard to become members of most luxury hotel preferred partner programs, putting our clients’ status ahead of any luxury credit cards.

Chase Sapphire Preferred vs. Reserve

Why We Like It: The Sapphire Preferred is the best all around entry level travel credit card, in my opinion. Particularly because of the low annual fee, good sign up bonus, and easy points transfer system. Perfect if you are the occasional traveler, taking 1-2 trips a year.

- Lower annual fee: $95 annual fee compared to the Reserve’s $550.

- Good rewards rate: 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Ultimate Rewards Hotel Credit, plus more.

- Flexible rewards redemption: Points can be transferred to 1:1 travel partners, redeemed for travel statement credits, or used for other purchases. Partners like United, Emirates, Hyatt, Marriott & more.

The only thing I wish the Chase Sapphire Preferred had was lounge access. If this is important to you, it may be worth looking into the Chase Sapphire Reserve. I personally upgraded to the Chase Sapphire Reserve and love it.

The Chase Sapphire Reserve card has a $550 annual fee but you receive airport lounge access, reimbursement of the application fee for TSA PreCheck or Global Entry, and $300 travel credit for travel expenses. Perfect if you are a frequent traveler who values these perks.

- Premium travel benefits: Includes Priority Pass Select membership for airport lounge access, Global Entry/TSA PreCheck application fee credit every four years,and travel insurance like trip cancellation/interruption insurance.

- Higher rewards rate: Earns 3x points on travel & dining and 1x points on all other purchases.

- Bonus points on travel booked through Chase: Earn 5x points on flights and 10x points on hotels and car rentals booked through Chase Ultimate Rewards.

- Higher points value when redeemed for travel: Points are worth 1.5 cents each when redeemed for travel through Chase Ultimate Rewards.

Capital One Venture vs. Venture X

Why We Like It: Simple rewards and flexible redemption has made the Capital One Venture a very popular travel card. Similarly to the Chase Sapphire, this a a great entry beginner travel credit card. This card doesn’t require you to be loyal to a single hotel chain or airline, but you can take full advantage of the perks.

- Lower annual fee: $95 annual fee compared to the Venture X’s $395.

- Rewards rate: Unlimited 2x miles on all purchases: This flat-rate earning makes it easy to accrue rewards without worrying about category restrictions. Earn 5x miles on hotels and car rentals booked through Capital One Travel.

- More flexible rewards: Miles can be redeemed for travel purchases, statement credits, or transferred to a wider range of travel partners.

Good to note that Capital One airline partners do not include any large U.S. airlines. Again, I wish the Venture card had lounge access but if a priority, this is included in the Captial One Venture X. Best for frequent travelers, booking at least 3 trips a year to offset the annual fee. Capital One Venture X is a good card for luxury travel, however, it has less flexible rewards compared to other options. They push booking through Capital One Travel so if you prefer to make direct reservations with airlines, hotels or use an advisor for those bookings, look elsewhere.

- Higher annual fee: $395 annual fee compared to the Venture’s $95.

- Higher rewards rate: Earns 2x miles on all purchases and 10x miles on hotels and car rentals booked through Capital One Travel and 5x miles on flights booked through Capital One Travel.

- Airport lounge access: Includes Priority Pass Select membership granting access to over 1,300 lounges worldwide.

- Uber credits: Up to $200 in Uber credits annually.

- Global entry/TSA PreCheck application fee credit: Covers the application fee for either program every four years.

- Less flexible rewards: Miles are redeemed through Capital One Travel or transferred to partner travel programs.

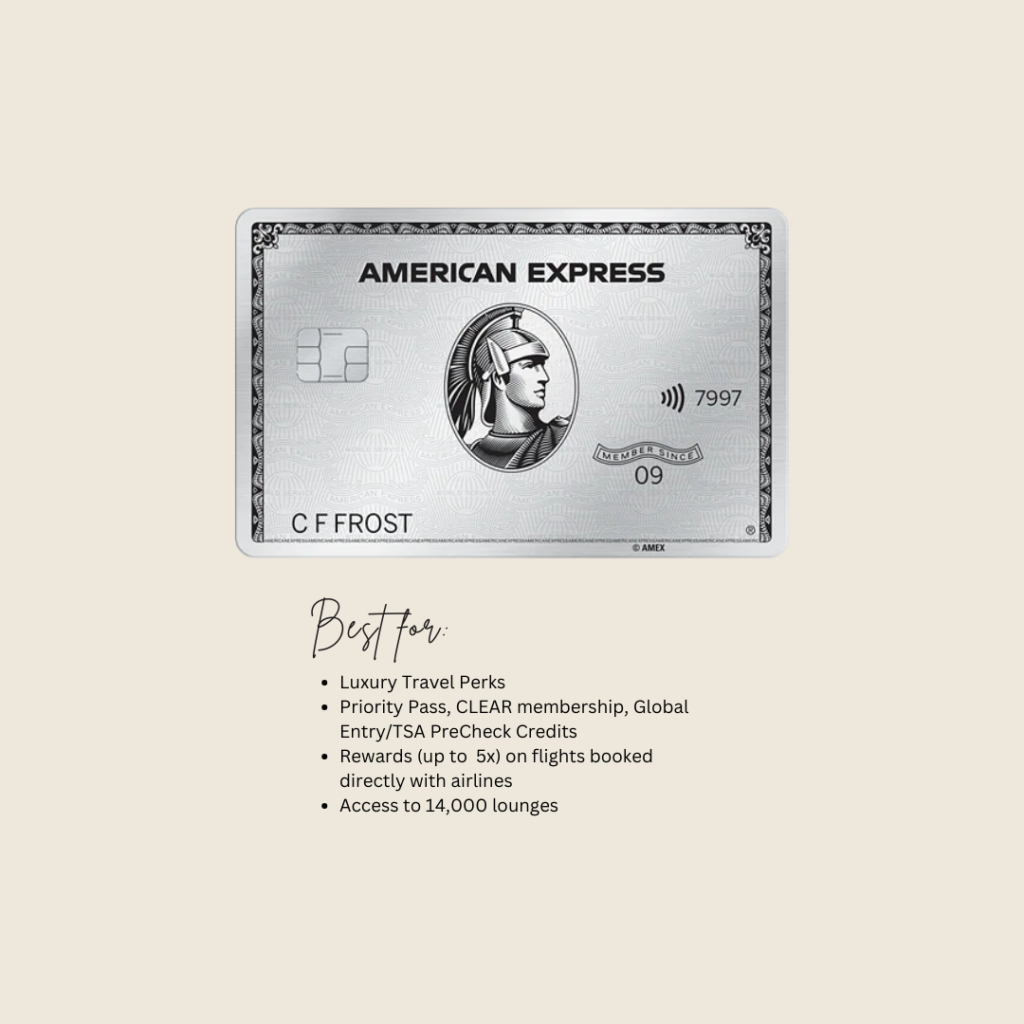

American Express Platinum Card

My favorite thing about the Amex Platinum is you are able to earn the 5x points on flights booked directly with the airline. As a Travel Advisor, I’m always a fan of booking with our flight desk for added suppport or directly with the airline. You do not want a flight delay or cancellation resulting in waiting on the phone with a credit card company. We like travel to be as seamless as possible so I very much appreciate that you get the flight rewards outside of their travel portal. This card is ideal for lounge access, as it includes 14,000 lounge locations. Platinum is all about the luxury travel perks but if you are not traveling frequently and spending on luxury items, then the rewards do not cover the fee. My primary concern with this sought after card is international travel considering American Express isn’t as widely accepted globally as Visa and Mastercard.

- High annual fee: $695 annual fee makes it one of the most expensive cards on the market.

- High rewards potential: Earns 5x Membership Rewards points on flights booked directly with airlines or on Amex Travel (on up to $500,000 in purchases per year), 5x points on prepaid hotels booked on Amex Travel, and 1x point on other purchases. Points can be transferred to a wide range of travel partners or redeemed for statement credits.

- Extensive travel benefits: Includes Priority Pass Select membership for airport lounge access worldwide, Uber Credits up to $200 annually, CLEAR membership for expedited airport security, Global Entry/TSA PreCheck application fee credit every four years, hotel elite status with Hilton and Marriott, and travel insurance benefits like trip cancellation/interruption insurance.

- Limited flexibility for point redemption: While points can be transferred to several partners, they are most valuable when used for travel booked through Amex Travel or redeemed for statement credits.

All of these cards have no foreign transaction fees, which is ideal for international travel.

When planning a trip with an advisor, it may be best to open a credit card and pay the deposit or final payment within the sign up bonus window. Our ability to create custom trip packages that allow for strategic payments (30%-50% deposit and final payment due 30-60 days before the trip) provides you with the exact amount due to ensure you receive the credit card welcome offer. We typically recommend applying the points or miles recieved to your flights or upgraded seats.

Remember that responsible credit card use is critical. Only apply for cards you can afford, and pay your bills on time, to avoid debt and maximize your rewards.